What Is Paycheck Protection Insurance?

Paycheck Protection Insurance is a generic term used to describe insurance policies, in the health insurance industry, that are designed to help an individual or business replace lost income in the event of a disability that prevents the individual or business owner from working.

Back To Top

Short Term Disability Insurance

Short term disability Insurance covers an illness or injury that keeps you from performing your regular job for 14 days and with some policies up to 24 months.

Benefits can range from about 60-80% of your regular salary.

The average cost of a short term disability policy is generally 1-3% of your annual premium.

The only question left is would you be willing to pay 1-3% of your salary in order to protect 60-80% of it?

Back To Top

Long Term Disability Insurance

Long term disability insurance covers an illness or injury that keeps you from performing your regular job for 2 years or with some policies up to age 65; when you are able to take social security and Medicare.

Benefits can range from about 40-60% of your regular salary.

The average cost of a Long Term Disability Policy is generally 1-3% of your annual premium.

Back To Top

Critical Illness Insurance

Critical Illness Insurance is a policy that will pay a lump sum cash payment to the account holder if they are diagnosed with one of the covered conditions. The typical conditions that are covered are:

The lump sum cash payments can range from $10,000 to $1,000,000 depending on how much coverage the individual is looking for.

A good rule of thumb when determining how much of a critical illness benefit you may need is to take your average monthly expenses and multiply them by 24 (2 years). So that you would potentially have 2 years-worth of expenses covered while you recover or undergo treatment for your critical illness.

The cost of a critical illness policy is determined through an underwriting process similar to a Life Insurance policy. The individual’s health and age are factored in when determining a monthly premium for critical illness insurance.

The number 1 cause of bankruptcy in the United States is Medical Bills. Don’t let and unexpected Medical expense threaten your financial future.

Back To Top

Key Person Disability Insurance

Key Person Disability Insurance is a policy that a business buys to cover an important employee or partner in the business. This is a unique disability insurance policy in that a business buys the policy to reimburse themselves if a key employee becomes disabled and is unable to work.

Key Person Disability Insurance and Key Person Life Insurance policies are normally purchased to cover an important employee that a business can’t do without: a top performing salesperson, the company accountant/controller, etc.

The cost of hiring and training a replacement employee in the meantime, in addition to the lost revenue that the key employee usually generates, can take a heavy financial toll on a business that doesn’t have proper planning in place for the loss or temporary loss of a key employee.

The Benefits on a key man policy tend to last for about 12-24 months.

Please keep in mind that this policy is for a business to purchase on behalf of themselves; the disability benefit is paid to the employer not the employee.

The key person, if not offered a group disability insurance plan by the employer, would want to buy their own individual disability insurance policy and probably a critical illness policy as well. This would help cover their own paycheck in the event of disability and would protect them from the unforeseen costs of a critical illness.

Back To Top

Business Overhead Expense (BOE) Disability Insurance

BOE Disability Insurance is a plan designed for business owners, and to protect their business in their absence.

It is designed to make monthly payments to the business should the business owner become disabled.

This type of policy is different from a key person disability insurance plan in that it is designed to cover monthly business expenses. Whereas key person is designed to help replace & train a replacement employee for the short or long term.

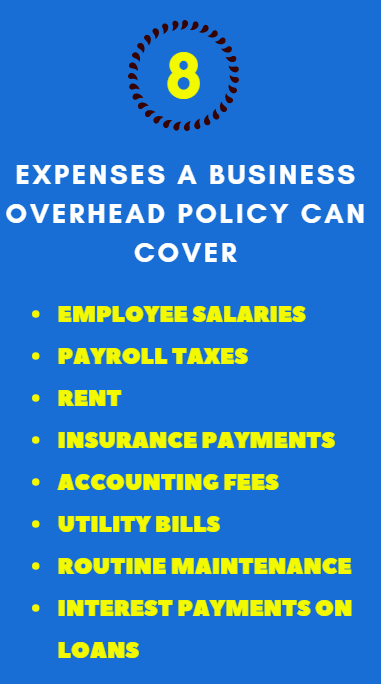

The Typical expenses that a business overhead expense policy can cover include:

The benefits on a BOE policy are only meant for short amount of time; usually less than 2 years. It is meant to keep the business running while the business owner retires.

The cost of a BOE policy is determined by: the business owner’s age, health, their duties at the company, and how long they want the policy to last.

If your absence, even for a short time, would severely jeopardize the future of your business you definitely want to consider a Business Overhead Expense Disability Insurance policy to protect the future of your business.

Back To Top

Disability Business Buy-Out Insurance

A Disability Business Buy-Out Insurance policy is a policy designed to help small to medium sized businesses that have 2 or several partners with ownership interest in the company.

If one of the partners becomes disabled and is unable to work anymore, this policy would allow the other partners to purchase the disabled partner’s portion of the business so that business operations can continue as normal.

The partners of the firm should meet with a CPA or financial planner in order to determine what their buyout amount would be in the future if something were to happen to them that prevented their return to work.

You do not want to be negotiating a buyout while one of the partners is disabled. Each partner should, early on in the partnership, determine their buyout amount and amount of Disability Business Buy-Out Insurance coverage necessary to buy their portion of the business.

It is very important to do this planning early on so that attempts to buy out a disabled partner, without a prior agreement, don’t seem like a predatory business practice.

Any business Buy & Sell Agreement should incorporate both a Disability Business Buy-Out Insurance policy for each partner in the business, and a Life Insurance policy on each partner that covers their respective buyout amounts.

Back To Top

Long Term Care Insurance

Long Term Care Insurance is an insurance plan designed to pay for the caregiving costs that an individual might incur if they became disabled.

This is different from a Long Term Disability Insurance policy in that an LTD policy is designed to replace all or a portion of your income if you become disabled, whereas a Long Term Care policy is designed to pay the costs associated with being disabled.

These costs are generally in the form of paying for care:

- At Home

- An assisted living facility

- A skilled nursing facility

A person who needs long term care is generally considered to be someone who is not capable of performing 2 out the 6 activities of daily living (ADLs):

The cost of a long term care plan varies based on age. The older you are the more expensive a plan will be.

Most experts recommend that you start your long term care planning around age 50 because at this age you can still receive a good rate for long term care insurance and you have a high likelihood of having your plan accepted by the carrier.

The older you are the more likely the insurance carrier will be to not issue a long term care policy for you.

Back To Top

Bank Loan Disability Insurance

Bank Loan disability Insurance is a type of policy designed to help small business owners. It is designed to pay off a business loan or line of credit if the business owner is disabled and unable to make payments on the loan.

This is different from a short term or long term disability policy in that short & long term disability policies are meant to replace one’s income, whereas a Bank Loan Disability policy is meant to pay the monthly payments of a business loan.

More and more banks are requiring disability policies like this to be in effect to guarantee that the bank will continue to be paid on the loan that they have made.

This policy would not be necessary unless a business owner takes out a line of credit on behalf of the business.

Back To Top

Life Insurance

Life Insurance is different from all of the other varieties of Paycheck Protection Insurance because it is not meant to be used during the course of your lifetime.

Life Insurance is designed to replace your paycheck, for your family, after you have died and are no longer able to provide for them.

Of all the forms of paycheck protection, life insurance is the number one policy that everyone should should have as a part of their insurance portfolio.

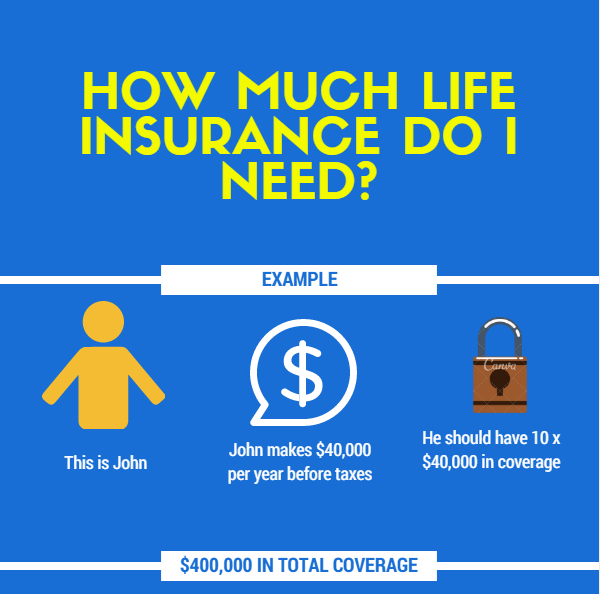

Most life insurance experts recommend that that you get a policy that is 10 times your income on a before tax basis.

If you are single, this should be sufficient to cover any debts that you might have that may need to be settled after your passing.

If you are married with children you will want to meet with a life insurance professional that can help you determine what amount of life insurance you may need to help settle your estate in the event of your passing. the standard 10 times your pretax income may not be sufficient for you depending on: your standard of living, amount of debt, and future plans for your children (school, work, etc).

Back To Top

If you still have additional questions about ways to protect your paycheck please don't hesitate to contact The Lynn Company at 661-873-2200 for more information on Paycheck Protection Insurance

Posted Friday, April 21 2017 10:22 AM

Tags : Paycheck protection insurance, short term disability insurance, long term disability insurance, critical illness insurance, key person disability insurance, business overhead expense disability insurance, BOE policy, disability business buy-out insurance, Long Term Care Insurance, bank loan disability insurance, life insurance

|